Bitcoin is the oldest and most successful cryptocurrency in the world. Bitcoin fills the headlines of various media outlets around the world every day. While many want to profit from its success, others are indifferent or even skeptical. Unfortunately, few people want to understand it.

Today, anyone can join the peer-to-peer network known as Bitcoin. The network allows you to securely store value over time and send that value to anyone, at any time, without the need for a third party (such as a bank or intermediary). Unlike today’s “normal” money, Bitcoin has a fixed and transparent creation and release schedule, and that schedule cannot be changed on demand. We can consider it the cash of the internet. The maximum amount of Bitcoin that can ever be produced and put into circulation is 21 million (21,000,000).

Bitcoin, as a digital currency, has sparked numerous debates about technology, money, and investment. Some view Bitcoin as just another market bubble and describe it as a mere speculative tool, while others speak of it as a technological innovation, a monetary revolution, or even a means that can save us from the clutches of the current monetary system.

Various countries, such as China, view Bitcoin as a threat and have declared a “war” on it. However, other countries, such as El Salvador, have recognized Bitcoin as legal tender in the hope that it will stimulate economic growth.

Why is Bitcoin Important?

You’ve probably asked yourself at least once in the past few years: Why all the hype around Bitcoin? It’s almost impossible to open any news portal or social media app today without encountering some form of information about Bitcoin . You might wonder: why would anyone even want to own Bitcoin? The answer to that question is quite simple. More and more people realize that they can truly own something that is digital, something that cannot be forged, and something that cannot be taken from you unless you willingly give it up.

Bitcoin is resistant to censorship and enables cryptographically secure cross-border payments. Since no individual or group (third party) is responsible for carrying out these transactions, it is the first and only example of truly scarce digital assets. Therefore, Bitcoin cannot be affected by any government in the world.

Collision of Worlds

In the past, precious metals were used as a means of payment, which were later replaced by cash in the form of coins and banknotes. Their advantage is that they can be stored and spent independently of third parties. The saying “cash is freedom” illustrates this characteristic very well. However, the drawback of precious metals and cash is that they are difficult (almost impossible and completely impractical) to use in the digital space. After the rapid growth of e-commerce, debit and credit cards took over as the dominant payment methods in the online space.

Today, when the vast majority of people use digital money (which exists only as a digital record in their bank accounts) instead of cash, the risks associated with dealing with a second party increase. What exactly does the risk of the second party mean? For example, if a financial institution (bank) announces that it has become insolvent, the savings of its clients could be irretrievably lost (regardless of the fact that states guarantee that deposits up to 100,000 euros in banks are insured and that the state will settle this debt with its citizens). Or, as happened in 2013 in Cyprus, where cash withdrawals were limited, capital controls were introduced, and citizens’ savings accounts were forcibly seized. With one decision from the authorities, overnight, people lost their savings. Or, as is the case today in “developed Western democracies,” a bank can unilaterally ban a client from sending money to their family in Cuba, Iran, or any other country. If they manage to send their money, the intermediary fee (the third-party fee for the service) will surely leave a bitter taste in their mouths. All of these and similar cases represent the risk of a third party where people are left at the mercy of a system that can allow, but also, without explanation, forbid such transactions. Due to the growing number of “intermediaries” such as banks and parasitic bureaucratic institutions, people are losing control over their money.

With the transition from paper to digital money, which is only a record in bank accounts, we gave up control over our own money. But up until now, this was the price one had to pay if they wanted to participate in the “digitalized life.”

Bitcoin offers a solution to this problem. As digital money, it is ideal for use in the digital space. At the same time, Bitcoin can be stored as digital ownership without relying on third parties (banks) to hold it for us. Therefore, Bitcoin owners can store it in the form of private keys. These private keys can be considered passwords to access the Bitcoin, which always resides on the blockchain. Individuals can store these private keys however they wish. Just like cash, they can store it under the mattress, but it would be much wiser to learn and memorize those few words that serve as a password.

The blockchain is a bank. A bank that belongs to all of us, yet belongs to no one. A bank where no one has preferential access, regardless of how much money (Bitcoin) they have in it, where they come from, their skin color, or their political or religious beliefs. The blockchain is a bank where we are all absolutely equal. There are no “equal” and “more equal” individuals.

The Perfect Moment

Bitcoin was created during the global financial crisis of 2008/09. In the first block of the Bitcoin blockchain – also known as the Genesis Block – Satoshi Nakamoto left a hidden, powerful message. In that message, he quoted a headline from the January 3, 2009 edition of The Times: “Chancellor on brink of second bailout for banks.”

Satoshi Nakamoto, with this act, expressed his criticism of governments and the politicians who manage them, which is a sentiment shared by all Cypherpunks. During the financial crisis of 2008, central banks flooded the economy with huge amounts of newly printed money to save the banks. The price of this bailout was paid by ordinary people like you and me, because our money and savings lost value. It lost value because the money created out of nothing by the banks devalued the money we earned through labor. The release of money into circulation in this way causes inflation, which we can easily describe as a reduction in purchasing power. It is clear to everyone, and we all feel it, that 100 euros today can buy much less than it could have bought a year ago. This is inflation, or a hidden tax that we all pay. But we pay it with money that we must earn, while governments and banks pay it with money they create as needed, in quantities they deem necessary. This is the harsh reality of today’s world and the reason why Cypherpunks distrust governments and their central banks, which has solidified their belief that the world needs money that is completely separate from the state that controls it.

Today, all those who have fully understood this, i.e., understood Bitcoin, are united in the fight, in a peaceful protest demanding the separation of the state from money.

The same situation, but on a much larger scale than in 2008/2009, repeated itself after the outbreak of the COVID-19 hysteria. In 2020 alone, the money supply in the U.S. increased by nearly 50%. The European Union is no better in this regard. The money printers never stop, as the saying goes. The consequences of this are extremely low interest rates, and easily accessible money raises the prices of all goods and services. The rise in prices devalues money for those who save it, and that is inflation.

How to Protect Against Currency Devaluation

Bitcoin was probably launched at the best possible moment. Rarely has the issue of money been more relevant than today. With its absolutely limited supply of 21 million, Bitcoin is the complete opposite of the endlessly expanding balance sheets of central banks. Its limited supply acts as a safeguard against the devaluation of your money, as is the case with all today’s fiat currencies issued by central banks that lose value every day.

Due to its unique design, Bitcoin was created to ensure the preservation of purchasing power over long periods of time. Since Bitcoin is already rare by its nature, it is even a better store of value than gold. The new supply of gold entering circulation annually ranges from approximately 1-2% of the existing total supply. Additionally, the storage and “transportation” costs of Bitcoin, compared to gold, are significantly lower, which also adds value over time.

Asset Protection

Another problem that Bitcoin perfectly solves is asset protection. Cash or gold, in order to be protected from theft, must often be stored in bank vaults, which incurs significant costs (especially in the case of gold). Just imagine the transportation and insurance costs for gold being moved from one place to another or across borders. Bitcoin is the complete opposite of this. The cost of storing and “transporting” Bitcoin is nearly zero. Even large amounts of Bitcoin that a person wants to move from one part of the world to another (worth billions of euros) have the same cost as moving just a few euros worth. Anyone can do this by simply knowing their private key, which often consists of a sequence of 12 or 24 words. Once memorized and physically destroyed, this word sequence ensures that your Bitcoin cannot be stolen or confiscated. This word sequence secures your Bitcoin on the blockchain and allows you to access it anywhere, anytime in the world. It ensures that, if you wish, you can take your Bitcoin to the grave with you.

How Bitcoin Works

The basic concept behind the Bitcoin network is that it is decentralized. Decentralization means that no participant in the network has the ability to impose or change the rules based on which the network operates. Network management is decentralized, and the power to govern is distributed among all the participants. This is the fundamental feature of the network: no individual, company, or government can “take over” the network and change the rules independently. Rules can only be modified by the consensus of all network participants.

To simplify, the functioning of the Bitcoin network is based on each participant in the network (those running a Bitcoin node or network Bitcoin node) having an identical copy of the transaction ledger (the Bitcoin ledger or blockchain) at all times. As a result, all participants on the network always know who owns how much Bitcoin. No one can claim to own a certain amount of Bitcoin they do not possess, as it can easily be verified in the transaction ledger stored on your network node.

Before the creation of Bitcoin, decentralized networks always faced two major challenges. The first challenge was how to ensure that every participant on the network receives the latest updates, containing information about changes in ownership and how much Bitcoin has changed hands. The second challenge was how network participants could confirm with absolute certainty that the information they received about ownership changes was completely accurate.

Blockchain

The blockchain technology provided answers to these questions. By using blockchain, information is stored chronologically as it arises. In the case of Bitcoin, all information since the network’s launch has been stored in hundreds of thousands of blocks, which are linked together to form the blockchain. Every participant on the network can check who owns how much Bitcoin by tracking the transaction history on the blockchain. So, if someone wants to send Bitcoin to someone else, they can simply verify whether the sender actually possesses the amount of Bitcoin they claim to have.

You may be wondering, this mechanism doesn’t seem so revolutionary compared to how it’s been presented. After all, every bank today has a similar record (database) where they can check the balance of any user or track the history of all their transactions. For example, if a bank customer wants to transfer a certain amount of euros from their account to another, the bank will simply check whether the user has enough euros in their account or if the amount has already been spent. The unique characteristic of Bitcoin’s blockchain, compared to a bank’s database, is that it is not stored in one central location (the bank’s central server), but an identical copy is stored on all computers (Bitcoin nodes) worldwide, with over 30,000 nodes today. This is also why the Bitcoin network is not easily “attacked,” shut down, or shut off. To do so, you would need to shut down every Bitcoin node in the world simultaneously.

However, blockchain faces the challenge that every participant in the network can verify with absolute certainty whether their copy of the blockchain is accurate and ensure that no false or erroneous transactions are added to their version of the ledger. Since new blocks (which contain new transactions) are added to the blockchain approximately every 10 minutes, the blockchain’s size is constantly increasing and must be continuously updated on all connected computers.

All new blocks that are added to the blockchain must be verifiable by every participant. This verification happens based on rules defined in Bitcoin’s computer code, which cannot be altered. These rules precisely define which transactions are allowed and which are not. Every user who downloads the blockchain to their computer can check whether all transactions comply with the set rules. If any new transaction doesn’t comply with the rules, or if it’s incorrect or fraudulent, network participants reject it and do not include it in the blockchain.

Proof-of-Work and Mining

Bitcoin operates on the principle of using a proof-of-work mechanism. To add a new block to the blockchain, a participant must provide proof of work. This proof of work is also the mechanism that limits who can add a new block to the blockchain and when. Without this mechanism, the network would likely have failed and been forgotten long ago. In order to find a new block and add it to the existing blockchain, participants must invest work into finding it. As a reward for finding the block and adding it to the blockchain, the finder is rewarded with new Bitcoin and the transaction fees contained in the new block. Once the new block is found and added, the process starts over.

This process of finding a new block is called mining. In this digital mining process, miners run specialized computers executing a mathematical hash function (the SHA-256 algorithm) in search of specific numbers. The hash of the previous block, the transactions of the current block, and a random number (nonce) are all input into the hash function. This random number changes until the hash function produces a result with a minimum number of leading zeros. For example, block 767700, found on December 16, 2022, had a valid hash: 00000000000000000001f923407f16129a16e0b15122f6750444b44ceff86c37.

Bitcoin block 767700

The mining process serves two primary functions: First, it connects the blocks mathematically and cryptographically, ensuring that anyone can easily check the order of their creation. Simultaneously, the proof-of-work mechanism makes it nearly impossible to change the order in which the blocks were added to the chain. The second function is that this proof-of-work mechanism ensures that every new block is added to the blockchain approximately every 10 minutes. This interval between two new blocks is long enough for all participants on the network worldwide to have enough time to update their blockchain copy to the most recent state.

As a conclusion, miners maintain the Bitcoin network’s activity. Through mining, all new transactions are processed and added to the blockchain. Bitcoin nodes (nodes) keep copies of the ledger. The computer code that runs on them ensures the rules are followed and that no fraudulent transactions are added to the blockchain.

21 Million

The total number of Bitcoins that can ever be created is 21 million. This is defined by the core program code on which Bitcoin is based, and this constant cannot be changed. As new blocks are added to the blockchain every 10 minutes or so as a result of proof-of-work by miners, they are rewarded with Bitcoin for each new block added to the existing chain. The amount of Bitcoin awarded to miners for each new block is also defined by the core Bitcoin code. Like in the previous case, this constant also cannot be altered. The schedule for issuing new Bitcoins follows a strict timetable.

When the Bitcoin network was first launched, the program code allocated 50 new Bitcoins for each new block added to the blockchain, or roughly every 10 minutes. Four years after the launch of the Bitcoin network, the number of Bitcoins awarded to miners for their work halved to 25 new Bitcoins per block, or every 10 minutes. This predefined process is called halving. The halving occurs approximately every 4 years, or after 220,000 new blocks are added to the blockchain. To date, over 19 million Bitcoins have been issued in this manner, and the current reward for a new block is 6.25 Bitcoins. Following this predefined schedule for adding new blocks to the blockchain and issuing new Bitcoins, it is anticipated that the last Bitcoin will be issued around 2140. After that, miners will be compensated only through transaction fees.

This absolutely limited supply of Bitcoin is one of its fundamental properties, making it an extremely rare and valuable “commodity.” This limited supply is also an important prerequisite for Bitcoin’s function as a store of value over long periods and is why Bitcoin is also referred to as digital gold.

Considering all the mentioned features of the Bitcoin network, it’s easy to understand the importance and value of this invention. For the first time in history, there is a digital “commodity” that cannot be copied or duplicated, and it is absolutely…

Satoshi Nakamoto

The name Satoshi Nakamoto appeared in the Bitcoin whitepaper and in the signature of an email sent to the previously mentioned email list. The true identity of Bitcoin’s creator remains unknown to this day. From all available data and extensive research on the subject, it can be concluded that the name Satoshi Nakamoto is likely just a pseudonym rather than the real name of a person. Satoshi Nakamoto used three different email addresses for correspondence, which were well encrypted, making it impossible for anyone to trace the actual sender of these emails.

To this day, many individuals have tried to associate themselves with the genius behind the Bitcoin invention and declare themselves as Satoshi Nakamoto. However, none of them have been able to provide definitive proof of this claim. None of these false claimants have proven that they control the addresses assumed to hold Bitcoin that belongs to Satoshi Nakamoto. To prove they are the creator of Bitcoin, someone would need to be able to send Bitcoin from those addresses to another Bitcoin address. This can only be done if they possess the private keys to those addresses, with which they could sign a transaction that would transfer Bitcoin to another address. To date, no one has provided proof of this.

Today, only a small number of people have “personally” (via the internet) communicated with Satoshi Nakamoto. On December 12, 2010, Satoshi Nakamoto sent his last message to the broader Bitcoin community. Nakamoto continued communicating with a smaller group of developers, keeping them informed about the state of the Bitcoin network. In April 2011, Nakamoto sent his last message to this inner circle of developers. Since then, Nakamoto has never contacted anyone again. Just as he mysteriously appeared in 2008, he mysteriously disappeared in 2011.

The “Genesis address” or the first-ever address where Bitcoin was sent is A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa. This address is believed to be owned by Satoshi Nakamoto, who personally sent Bitcoin mined initially to it. If you use a Bitcoin block explorer (e.g., www.mempool.space), you can see that this address has received Bitcoin in over 3,500 transactions, but there is no transaction showing that Bitcoin was sent from this address to any other address. You may wonder why, in over 3,500 transactions, Bitcoin was sent to the first-ever Bitcoin address. All these transactions contain small, symbolic amounts of Bitcoin, but they can be understood as a tribute to the creator of Bitcoin, Satoshi Nakamoto.

Bitcoin Pizza

How did Bitcoin initially acquire its value? In the beginning, Bitcoin could be “mined” and sent among network users, but it had no inherent monetary value. Additionally, very few people knew about Bitcoin or how to use it.

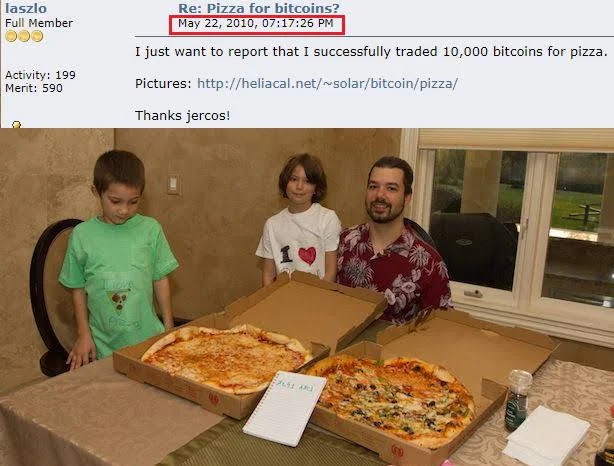

The first event that gave Bitcoin any monetary value happened on May 22, 2010, when an unusual ad appeared on the bitcointalk.org forum. A 28-year-old man named Laszlo Hanyecz from Florida offered 10,000 Bitcoins in exchange for two pizzas to be delivered to his address. A student from California accepted this offer and sent two pizzas worth $41 to his address. In return, Laszlo Hanyecz sent him 10,000 Bitcoins. From that day, May 22 has been celebrated in the Bitcoin community as Bitcoin Pizza Day. This day became significant because it defined three things:

- Bitcoin had value from that point on.

- Bitcoin was suitable as a medium of exchange and payment.

- Bitcoin as a currency is deflationary (the number of Bitcoins entering circulation over time decreases, which is a prerequisite for increasing its value).

These two pizzas will be remembered as the most expensive pizzas ever. Considering the highest recorded Bitcoin price of approximately $99,000, those two pizzas were worth $990 million. Also, the recipient of those 10,000 Bitcoins sold them shortly after receiving them and financed a private trip with that money. Applying the same logic with the highest Bitcoin price, it can be concluded that this trip was probably the most expensive trip ever paid for.

This pizza example best illustrates the popular term among long-term Bitcoin holders: “HODLing,” derived from the English word “holding,” meaning to hold. Holding Bitcoin in this sense implies holding Bitcoin “forever.” Why would someone ever sell their Bitcoin when it is almost certain (as historical data shows) that the value of Bitcoin will only increase over time?

What Gives Bitcoin Value

Bitcoin’s greatest value comes from its exceptional rarity. The maximum amount of Bitcoin that can ever exist is 21 million (21,000,000). Anyone with access to a regular computer can easily check this characteristic of Bitcoin. A huge amount of computing power is continuously dedicated to ensuring the accuracy and integrity of Bitcoin’s decentralized ledger. The ledger is a record of all transactions that have ever occurred on the Bitcoin network. The network literally pays people to maintain this integrity (in the form of mining rewards) and to act in good faith. The price of Bitcoin is simply determined by supply and demand on exchanges.

Furthermore, Bitcoin can be viewed from the perspective of the evolution of money. Using modern terminology, money always develops in the following four phases:

- Collectible items: In the first phase of its evolution, money is sought solely based on its distinctive properties. Items in this stage are often the passion of collectors or a small group of owners. Shells, pearls, and gold were collectibles before they evolved into higher forms of money.

- Store of value: After being sought by a sufficient number of people for its distinctiveness, money is recognized as a means of preserving and storing value over time. As a good increasingly takes on the characteristics of a store of value, its purchasing power grows because more people want to use it for this purpose. The purchasing power of stored value will eventually reach its peak when the good is widely represented and the influx of new users wanting to use it as a store of value decreases.

- Medium of exchange: Once money is firmly established as a store of value, its purchasing power stabilizes. After purchasing power stabilizes, the opportunity cost of using money for transactions will decrease to a level where it is suitable for use as a medium of exchange. In Bitcoin’s early days, many people did not appreciate the high opportunity costs of using Bitcoin as a medium of exchange rather than as a store of value. The well-known story of the man who exchanged 10,000 Bitcoins (worth approximately $225 million at the time of writing or $690 million at Bitcoin’s peak in 2021) for two pizzas illustrates this situation. In the world of Bitcoin, May 22 is celebrated each year as Bitcoin Pizza Day.

- Unit of account: When money is widely used as a medium of exchange, goods will be priced in relation to it. It is a common misconception that prices in Bitcoin are available for many goods and services. For example, while a cup of coffee may be paid for in Bitcoin, the listed price is not the actual price in Bitcoin but the price in dollars that the merchant is asking for that cup of coffee, translated into Bitcoin terms at the current exchange rate. If Bitcoin’s price in dollars drops significantly, the number of Bitcoins the merchant asks for will increase proportionally. Only when merchants (and all other traders) are willing to accept Bitcoin for payment regardless of Bitcoin’s exchange rate with fiat currencies, can we truly say Bitcoin has become a unit of account.

Currently, Bitcoin is in the second phase (store of value). It will likely take several more years before Bitcoin transitions to the third phase, where it will become a medium of exchange. Although it is already used as a medium of exchange today, it is not widespread enough to be considered in this phase. Bitcoin is most commonly used as a medium of exchange through the Lightning Network. Interestingly, it took gold centuries to undergo the same transition.

Who Controls the Network

The simple answer is: everyone and no one. The network is designed so that malicious actors cannot take advantage, and everyone has control over their participation in it. No programmer can independently make any changes to the Bitcoin code. No miner can filter any specific transaction. No user of the Bitcoin network can misuse the network to spend Bitcoin that does not belong to them or that they do not have.

Can a Government or State Stop Bitcoin?

There is no doubt that governments could ban Bitcoin within their borders. In reality, China has already done this several times, and the ecosystem still thrives. Due to Bitcoin’s decentralized architecture, stopping its expansion would actually require massive coordinated efforts from many major world countries. Such efforts to destroy the network would require huge financial resources and ultimately achieve nothing. Anyone can join and use the Bitcoin network from the simplest personal computer, making it unlikely that governments of major countries would attempt this because it would likely have the opposite effect.

Bitcoin Digital Gold

Bitcoin, which is just over ten years old, is still a relatively new technology. It is not yet fully ready for widespread use as money for everyday exchanges of goods and services. While it is possible today to buy and sell products and services with bitcoin, its primary function at this stage is as a store of value over the long term, or as a form of digital gold. Many people buy bitcoin and use it as a store of value over time due to its fixed and limited maximum supply, which can never increase. Anything that can retain its value or purchasing power over time is considered a store of value. Since governments around the world print endless amounts of money (the fiat currency we all use today), this leads to inflation in fiat currencies, and consequently to rising prices of all goods and services. As a result, traditional currencies are poor “stores of value.” In comparison, bitcoin tends to preserve its value over time due to its fixed supply.

People hold bitcoin as a form of digital gold to protect themselves against inflation. Bitcoin also has numerous advantages over physical gold, including the ability to send it almost instantly and at very low transaction fees anywhere in the world. Furthermore, storing bitcoin is much easier than storing gold. Bitcoin can be kept on a hardware wallet, computer, smartphone, or an online bitcoin exchange. To store your bitcoin, you don’t need to buy a safe or rent a vault in a bank. Unlike gold, bitcoin can also be easily transferred across international borders, as mentioned earlier.

Transactions Can Be Tracked

In the bitcoin “public ledger,” every bitcoin transaction is recorded. Anyone in the world can view all transactions by searching a Block Explorer online and entering a specific transaction or wallet address. More about Block Explorers can be read here. Using cryptographic methods with public and private keys, the identity of the bitcoin wallet owner and the wallet address are kept private. However, the identity of the user can be uncovered if additional information about the bitcoin wallet owner is voluntarily provided during use. Therefore, using bitcoin wallet addresses only once is a solid operational security practice. Today, there are many companies in the market that focus on tracking entities on the blockchain. One of the most well-known is Chainalysis. The company works with businesses and governments to “increase blockchain transparency” to more easily identify specific users and provide data and analysis services to large companies.

Bitcoin in Online Gambling

Bitcoin has become increasingly present in online gambling, bringing numerous advantages that simplify payment processes and improve the experience for users. One of the key advantages of Bitcoin is the speed of transactions. In traditional payment methods, such as bank transfers or credit cards, it can take several days for transactions to be processed, whereas Bitcoin enables almost instant transactions. This means players can deposit funds into their accounts and withdraw winnings without delay.

Additionally, Bitcoin reduces transaction costs. Banks and payment processors often charge high fees for processed deposits and withdrawals, while Bitcoin transactions have significantly lower fees. These lower fees make Bitcoin appealing for users who want to keep more of their funds instead of paying for transaction costs.

Another benefit of Bitcoin is its level of privacy and anonymity. Unlike traditional payment methods that require personal information from users, Bitcoin offers more privacy since transactions are not directly tied to the user’s identity. While Bitcoin transactions are transparent on the blockchain, users can utilize different addresses, increasing their anonymity.

Global accessibility is also a significant advantage. Bitcoin is accepted in almost every country and does not require currency conversion, which allows players from around the world to engage in online gambling regardless of their location. This provides players with easier access to global gambling platforms.

However, while Bitcoin has many advantages.Bitcoin offers high security. The use of advanced cryptography ensures that transactions are secure, and additional protective measures, such as using hardware wallets, help safeguard funds from potential threats.

Bitcoin has become a significant option for many online gamblers looking for fast, cheap, and secure ways to carry out transactions. However, it is important to be aware of its volatility and understand the risks that come with using this cryptocurrency for gambling.

Bitcoin Lightning Network: A Scalable Solution for Fast and Low-Cost Payments

The Bitcoin Lightning Network is a scalable solution designed to enable fast and cheap payments on the Bitcoin blockchain. Instead of each transfer going through the Bitcoin blockchain, the Lightning Network uses payment channels between users for direct transactions that are not immediately recorded on the blockchain. These transactions allow for quick and inexpensive payments, easing the load on the main network.

The Lightning Network operates as a second-layer protocol built on top of the Bitcoin blockchain. It enables users to create off-chain channels where transactions can occur without requiring every single transaction to be processed on the main Bitcoin blockchain. This network reduces the congestion and high transaction fees associated with the base layer, while offering nearly instant transfers and much lower costs.

To use the Lightning Network, users create payment channels between themselves. Once the channel is set up, they can send multiple transactions without waiting for each one to be confirmed on the Bitcoin blockchain. Only the opening and closing transactions are recorded on the blockchain. Transactions occur off-chain within the payment channel. These off-chain transactions are fast and have minimal fees because they do not require mining and block confirmations. When the users decide to close the payment channel, the final transaction is broadcast to the Bitcoin network, settling the balance and recording the net result on the blockchain.

The Lightning Network offers several advantages. It allows for almost instantaneous transactions. There is no need to wait for block confirmations, making it ideal for microtransactions and real-time payments. Traditional Bitcoin transactions can have high fees due to network congestion, especially during periods of high demand. The Lightning Network dramatically reduces transaction costs by eliminating the need for miners to validate each transfer. As the number of Bitcoin users grows, so does the number of transactions. The Lightning Network can handle a much larger volume of transactions without overwhelming the Bitcoin blockchain, improving scalability.

While the Lightning Network has clear benefits, it also faces certain challenges. Users must maintain sufficient funds in their channels for transactions to be processed. If liquidity is low, payments may fail or be delayed. Finding the optimal route for transactions within the network can sometimes be difficult, particularly when dealing with high-value payments or limited channels. Although growing, the network is still not universally adopted. For widespread use, both users and merchants need to support the Lightning Network.

The Bitcoin Lightning Network is a revolutionary development in the cryptocurrency world, providing a scalable solution to Bitcoin’s limitations in transaction speed and cost. It enables faster, cheaper transactions, making Bitcoin more accessible for everyday use. While there are still challenges to overcome, the Lightning Network has the potential to play a major role in Bitcoin’s adoption as a global payment system.

FAQ - Frequently Asked Questions

What is Bitcoin?

Bitcoin is a type of digital currency, created and stored electronically. It is decentralized, meaning it is not controlled by any government or financial institution. Bitcoin transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called the blockchain.

How does Bitcoin work?

Bitcoin operates on a peer-to-peer network where transactions are made directly between users. It uses blockchain technology to ensure security and transparency. Bitcoin can be sent and received through digital wallets, which store the cryptographic keys needed for transactions.

What is Bitcoin used for?

Bitcoin can be used for various purposes, including as a store of value (similar to gold), a medium of exchange for goods and services, and an investment asset. It is particularly popular among those seeking to protect their wealth from inflation.

Is Bitcoin legal?

The legality of Bitcoin varies by country. While it is legal in many countries, some governments have banned or heavily regulated its use. It’s important to check the regulations in your country before buying or using Bitcoin.

Is Bitcoin safe?

While Bitcoin itself is secure due to its cryptographic features, users must take precautions to protect their private keys. It’s recommended to store Bitcoin in a secure wallet, preferably a hardware wallet, to minimize risks of theft.

What is a Bitcoin wallet?

A Bitcoin wallet is a digital tool that allows you to store, send, and receive Bitcoin. It can be a software wallet (online or mobile) or a hardware wallet (a physical device that stores your keys offline for added security).

Why is Bitcoin’s price so volatile?

Bitcoin's price is volatile because it is a relatively new asset and its value is influenced by speculation, market demand, regulations, and news. As more people adopt Bitcoin, its price can experience sharp increases or decreases.

Can I use Bitcoin for everyday purchases?

es, Bitcoin can be used for purchases at some retailers that accept it as payment. However, due to its volatility, many businesses are hesitant to use it as a regular payment method.

s Bitcoin legal for online gambling?

The legality of Bitcoin for online gambling depends on the jurisdiction you are in. In many countries, Bitcoin is legal for use in online gambling, but it's important to check local regulations to ensure compliance.

How do I deposit Bitcoin in an online gambling site?

To deposit Bitcoin, you need to create a Bitcoin wallet, purchase Bitcoin from an exchange, and then transfer it to the gambling site's Bitcoin address. The process typically involves enterin

Can I use Bitcoin in all online gambling platforms?

Not all gambling platforms accept Bitcoin, but its use is growing rapidly. Many modern online casinos and betting sites now support Bitcoin as a payment method, but always check the payment options before signing up.